Getting My Medicare Graham To Work

Table of ContentsThe Single Strategy To Use For Medicare GrahamThe Only Guide for Medicare GrahamSome Known Details About Medicare Graham Getting My Medicare Graham To WorkSome Known Incorrect Statements About Medicare Graham Things about Medicare GrahamThings about Medicare GrahamFacts About Medicare Graham Uncovered

In 2024, this threshold was established at $5,030. When you and your strategy invest that quantity on Component D medicines, you have entered the donut opening and will certainly pay 25% for medications going ahead. As soon as your out-of-pocket expenses get to the 2nd limit of $8,000 in 2024, you run out the donut hole, and "disastrous insurance coverage" starts.In 2025, the donut opening will be largely eliminated in support of a $2,000 restriction on out-of-pocket Component D medication spending. As soon as you strike that limit, you'll pay nothing else out of pocket for the year.

While Medicare Component C functions as a choice to your initial Medicare strategy, Medigap interacts with Components A and B and aids fill up in any type of insurance coverage voids. There are a few important things to know concerning Medigap. You must have Medicare Components A and B before buying a Medigap policy, as it is a supplement to Medicare and not a stand-alone policy.

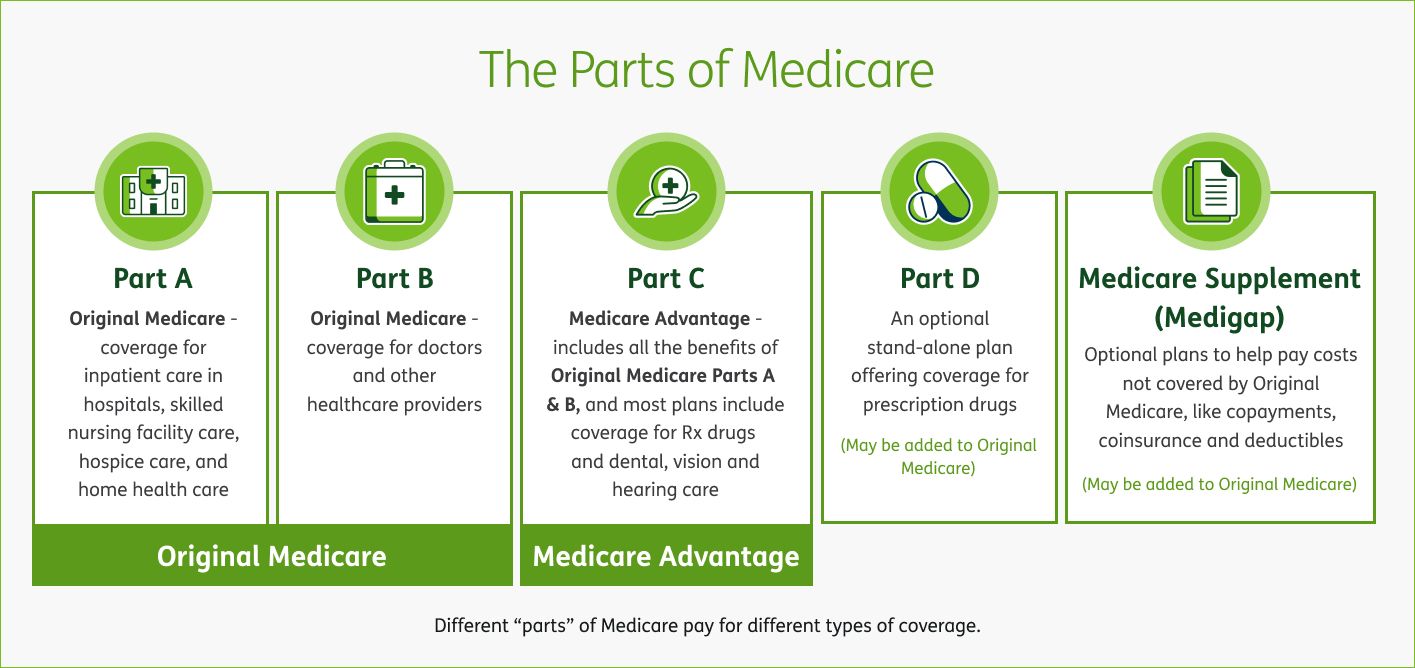

Medicare has actually developed for many years and currently has 4 parts. If you're age 65 or older and obtain Social Protection, you'll immediately be signed up partly A, which covers a hospital stay costs. Components B (outpatient services) and D (prescription medicine benefits) are volunteer, though under specific circumstances you might be instantly enlisted in either or both of these also.

Medicare Graham for Dummies

This write-up explains the sorts of Medicare prepares offered and their protection. It likewise supplies advice for individuals who care for relative with handicaps or wellness conditions and desire to handle their Medicare affairs. Medicare is composed of four parts.Medicare Component A covers inpatient medical facility care. It likewise includes hospice care, knowledgeable nursing facility care, and home medical care when an individual satisfies details standards. Monthly costs for those who need to.

acquire Component A are either$285 or$ 518, depending upon the amount of years they or their partner have actually paid Medicare tax obligations. This optional coverage requires a regular monthly premium. Medicare Part B covers medically required solutions such as outpatient medical professional brows through, diagnostic solutions , and precautionary services. Personal insurers sell and administer these plans, but Medicare needs to accept any type of Medicare Advantage strategy prior to insurers can market it. These plans give the very same protection as components A and B, however several additionally include prescription medication insurance coverage. Monthly premiums for Medicare Benefit plans have a tendency to rely on the area and the strategy an individual selects. A Part D plan's insurance coverage depends upon its price, medication formulary, and the insurance provider. Medicare does not.

The Greatest Guide To Medicare Graham

typically cover 100 %of medical prices, and most plans need an individual to fulfill an insurance deductible before Medicare spends for medical services. Part D typically has an income-adjusted premium, with higher premiums for those in greater revenue brackets. This relates to both in-network and out-of-network healthcare experts. Out-of-network

The Greatest Guide To Medicare Graham

care incurs treatment costsAdded For this kind of strategy, managers determine what the insurance company pays for medical professional and medical facility insurance coverage and what the strategy holder need to pay. An individual does not need to choose a health care doctor or acquire a recommendation to see a professional.

Medigap is a single-user policy, so spouses need to acquire their very own coverage. The expenses and benefits of different Medigap policies depend on the insurance provider. When it involves valuing Medigap strategies, insurance coverage carriers may use one of several approaches: Costs coincide despite age. When a person starts the plan, the insurance supplier variables their age into the premium.

The Medicare Graham Diaries

The insurance provider bases the initial premium on the individual's present age, yet premiums climb as time passes. The rate of Medigap prepares differs by state. As kept in mind, prices are lower when an individual purchases a plan as quickly as they get to the age of Medicare eligibility. Private insurer might additionally supply discount rates.

Those with a Medicare Advantage strategy are ineligible for Medigap insurance policy. The time may come when a Medicare plan holder can no longer make their very own choices for factors of mental or physical health. Before that time, the person ought to assign a relied on person to offer as their power of attorney.

The person with power of attorney can pay bills, documents taxes, collect Social Safety and security benefits, and select or transform medical care strategies on part of the guaranteed individual.

7 Simple Techniques For Medicare Graham

Caregiving is a demanding task, and caretakers typically spend much of their time meeting the requirements of the individual they are caring for.

military professionals or individuals on Medicaid, other alternatives are available. Every state, as well as the Area of Columbia, has programs that permit qualifying Medicaid recipients to manage their lasting care. Depending upon the specific state's guidelines, this may consist of working with relatives to offer care. Considering that each state's guidelines vary, those seeking caregiving repayment have to check out their state's demands.

Rumored Buzz on Medicare Graham

The cost of Medigap plans differs by state. As noted, costs are lower when a person acquires a plan as soon as they get to the age of Medicare qualification.

Those with a Medicare Benefit plan are disqualified for Medigap insurance. The moment might come when a Medicare plan owner can no longer make their own decisions for factors of mental or physical wellness. Prior to that time, the person should mark a trusted individual to act as their power of lawyer.

All about Medicare Graham

A power of lawyer record permits another person to conduct business and make decisions in behalf of the insured person. The individual with power of attorney can pay expenses, documents tax obligations, accumulate Social Security advantages, and pick or change health care intend on behalf of the insured individual. An alternative is to name a person as a healthcare proxy.

A release type alerts Medicare that the insured you could try this out individual permits the called individual or group to access their clinical details. Caregiving is a requiring job, and caretakers frequently invest much of their time fulfilling the needs of the person they are looking after. Some programs are available to supply monetary assistance to caregivers.

(https://www.kickstarter.com/profile/m3dc4regrham/about)Depending on the specific state's guidelines, this may include working with loved ones to provide treatment. Given that each state's guidelines differ, those seeking caregiving repayment must look right into their state's demands.

Comments on “Things about Medicare Graham”